Section 179 of the U.S. Tax Code: What Coffee Roasters Should Know in 2026

Section 179 Tax Deduction for Commercial Coffee Roasters (2026 Guide)

Section 179 of the U.S. tax code is one of the most relevant — and often misunderstood — provisions affecting how businesses invest in capital equipment.

For commercial coffee roasters considering new commercial coffee roasting equipment in 2026, Section 179 can materially affect the financial timing of that decision. Understanding how it works is worth a conversation with your accountant.

What Is Section 179?

Section 179 allows qualifying businesses to deduct the full purchase price of eligible equipment in the year it is placed into service, rather than depreciating it over multiple years.

Instead of spreading deductions over five, seven, or more years, a business may be able to expense the equipment immediately, reducing taxable income in the same year the asset begins generating revenue.

Congress has used Section 179 for years to encourage domestic investment in productive business assets. This provision often applies to U.S.-manufactured commercial coffee roasting equipment placed into service during the tax year.

Does Commercial Coffee Roasting Equipment Qualify?

In most cases, yes.

Commercial coffee roasting equipment is considered capital equipment used in active trade or business operations. When purchased and placed into service within the tax year, they generally qualify for Section 179 expensing, subject to IRS limits and the specific financial position of the business.

This applies to:

Dedicated production roasteries

Retail roasters with on-site roasting

Wholesale roasting operations

Multi-location coffee businesses

Final eligibility should always be confirmed with a qualified tax professional.

Why Section 179 Matters for Coffee Roasters

Coffee roasting equipment is a significant capital investment, but it is also a long-lived production asset. Well-built commercial roasters can operate reliably for decades.

Section 179 aligns the tax benefit with the year the equipment begins generating revenue.

For a growing roastery, this can:

Improve first-year cash flow

Reduce taxable income in a strong revenue year

Support expansion into higher-capacity equipment

Simplify financial planning compared to long depreciation schedules

In practical terms, it can reduce the effective after-tax cost of equipment in the year it is commissioned.

A Simplified Example (Illustrative Only)

This example is for general informational purposes only.

If a roastery purchases a $69,000 commercial coffee roaster and qualifies for full Section 179 expensing, that $69,000 may be deducted in the same tax year the machine is placed into service.

Depending on the company’s taxable income and overall financial structure, that deduction could materially reduce tax liability for the year.

Your accountant can model the specific impact for your business.

Timing and “Placed in Service” Requirements

To qualify in a given tax year, equipment must generally be:

Purchased, and

Placed into service before December 31

For commercial roasting equipment with build times, freight coordination, installation, and commissioning involved, this makes advance planning important.

Many roasteries begin equipment discussions earlier in the year to ensure delivery timelines align with their tax planning objectives.

For equipment with production lead times, delivery schedules should be reviewed early in the calendar year.

Important Note on Professional Advice

Tax regulations can change, and every business situation is unique. This article is intended for general informational purposes only and does not constitute tax advice.

Always consult a qualified CPA or tax advisor to determine how Section 179 applies to your business.

Final Thought

For profitable or scaling coffee roasters, Section 179 can significantly affect the economics of investing in commercial roasting equipment.

Even if equipment expansion was already under consideration, timing that investment within the current tax year may deserve renewed attention.

Sivetz Roasting Machines — Equipment Planning Conversations

If you are evaluating a new commercial coffee roaster in 2026, we are happy to provide production timelines and commissioning schedules so you can coordinate with your accountant.

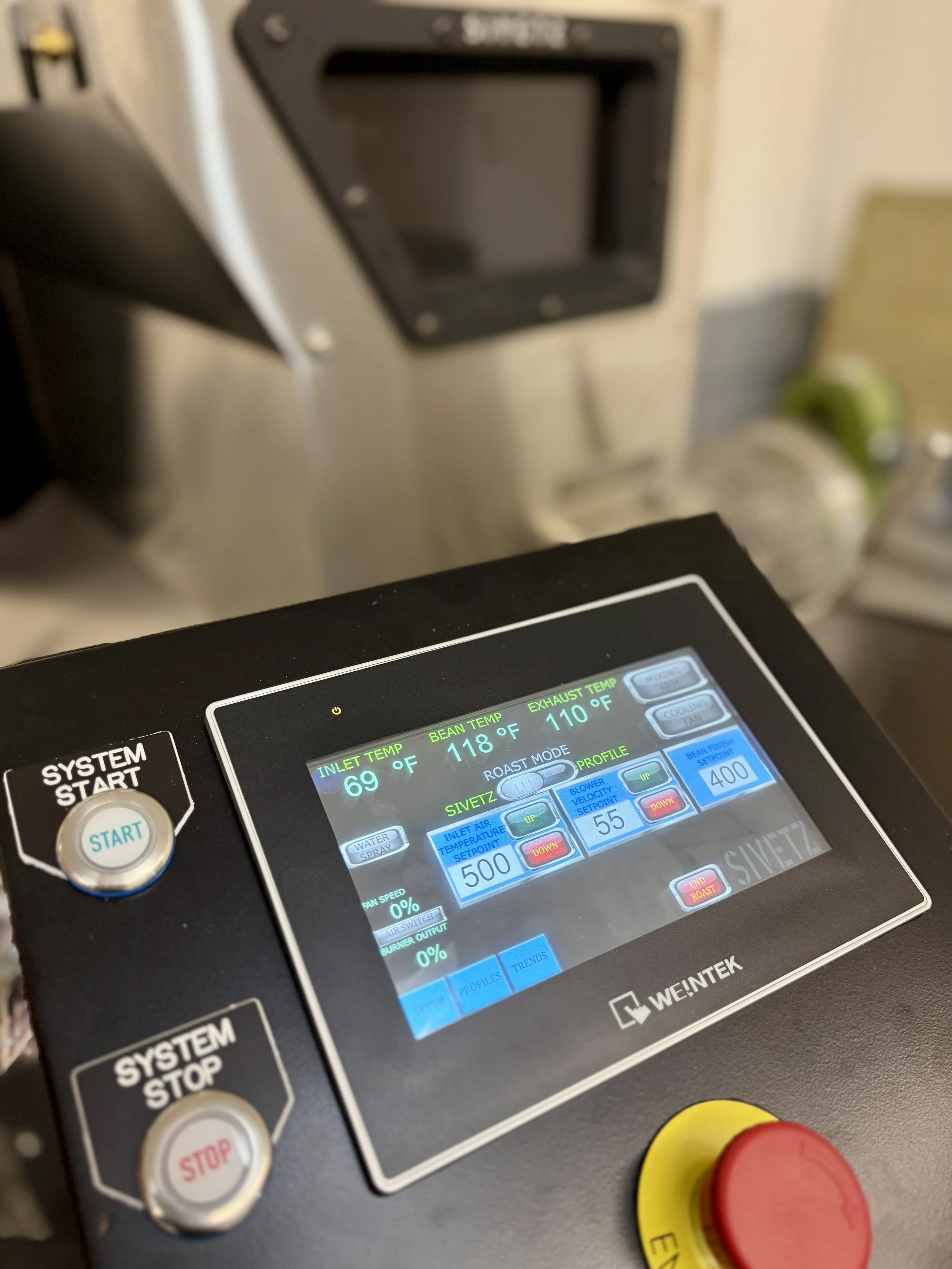

Sivetz Roasting Machines are built in Beaverton, Oregon, with headquarters in Hood River, Oregon, where we maintain an operational SRM15 for demonstrations and production roasting.

We currently manufacture the SRM15 platform and are developing the larger SRM35 using the same fluid-bed convection technology.

Equipment decisions should always align with operational needs first, but understanding the tax implications can make those decisions clearer.